This happens when the right transaction quantity is recorded but placed in the mistaken account of the identical category. Since the debit and credit amounts are nonetheless equal, the trial balance totals remain in balance. Nevertheless, the small print within your accounts are incorrect, which may distort your financial reporting and make it tougher to track particular prices or revenues accurately. A trial balance can be utilized to detect any mathematical errors which have occurred in a double entry accounting system.

How Are Accounts Listed In Trial Balance?

In this method, the adjusting entries are directly included into the unadjusted trial balance to transform it to an adjusted trial balance. In order to arrange a trial balance, we first need to finish or ‘balance off ’ the ledger accounts. Then we produce the trial balance by itemizing every closing stability from the ledger accounts as both a debit or a credit score steadiness. We have to work out the balance on each of those accounts to have the ability to compile the trial stability. Debits and credit of a trial steadiness must tally to ensure that https://www.simple-accounting.org/ there aren’t any mathematical errors. Nonetheless, there nonetheless could possibly be mistakes or errors within the accounting techniques.

It is a abstract of all the financial transactions which have taken place during an accounting period, making certain that the total debits equal the entire credits. This tutorial will information you through the detailed steps of getting ready a trial balance, together with the required background information, sensible steps, and common errors to keep away from. After all essential adjusting entries are posted, an adjusted trial steadiness is created. This model reflects probably the most accurate account balances for the reporting period and is the ultimate step earlier than preparing financial statements. The adjusted trial balance ought to have equal debit and credit totals.

The result’s the account stability, which will either be a debit or a credit. For instance, if the total debits within the Cash account exceed the credit, the account has a debit stability. Create the trial stability worksheet, listing each account and its ending steadiness. This process entails coming into the debit and credit amounts from the journal entries into the corresponding T-accounts in the ledger. Thus, it turns into straightforward so that you just can prepare the fundamental financial statements.

Steps To Prepare A Trial Steadiness

For instance, should you determine that the ultimate debit balance is $24,000 then the final credit steadiness in the trial steadiness should even be $24,000. If the 2 balances are not equal, there’s a mistake in no much less than one of the columns. Making Ready an unadjusted trial steadiness is the fourth step in the accounting cycle. A trial steadiness is a listing of all accounts in the general ledger that have nonzero balances. A trial balance is a vital step within the accounting process, as a result of it helps identify any computational errors all through the first three steps in the cycle.

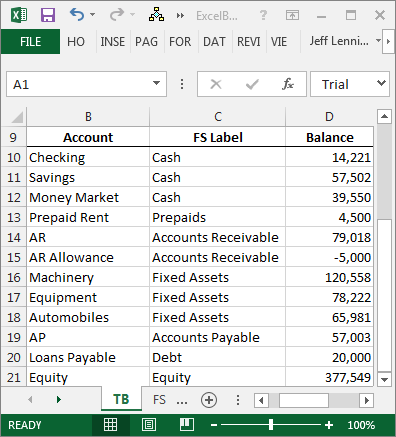

A trial stability is a report that summarizes with all of the debit and credit balances from a company’s general ledger. It is among the essential steps in accounting as it checks the correctness of economic records before financial statements are drawn. To prepare a trial balance you should place each account from the overall ledger with its debit or credit stability and sum up the debit and credit score columns to see that they agree. A steadiness trial helps check accuracy in document accounting before going to prepare financial statements like the stability sheet. This article describes the steps to produce a trial stability, the principle approaches, and its reference to the balance sheet and ledger entry.

An incorrect trial balance can lead to deceptive monetary reviews, which in flip can affect management choices, investor confidence, and regulatory compliance. Subsequently, making ready a trial stability with precision ensures transparency and accountability in monetary reporting. Balance sheet ledger accounts are closed by writing ‘Balance c/d’ subsequent to the balancing figure since these are to be rolled ahead within the next accounting period. A trial stability sheet features a list of basic ledger accounts together with their ending debit or credit score balances. Furthermore, a trial steadiness also includes the account number of each of the overall ledger accounts.

Closing Fairness Ledger Account

- Modern accounting software automates many steps of the trial balance course of, including journal entry posting, ledger updates, and adjusting entry ideas.

- In the Total Technique, the trial balance shows the total of debits and credit from each ledger account.

- All ledger balances are posted immediately within the total method into the trial steadiness.

This trial balance has the final balances in all of the accounts, and it’s used to organize the monetary statements. The post-closing trial balance reveals the balances after the closing entries have been completed. At interval finish, asset, expense, or loss accounts should have debit balances; legal responsibility, equity, income, or acquire accounts should have credit score balances. Nevertheless, some accounts could also be credited or debited during the interval, lowering their ending balances. This is an element eight of the accounting cycle and ensures your books are prepared to start the next accounting period.

For instance, if a debit is understated in a single account and a credit is also understated by the same amount in another account, the trial stability will still balance. These kinds of errors require deeper scrutiny past the trial stability stage, such as reconciliations and inside audits. Understanding and mastering the preparation of a trial balance lays a stable foundation for further monetary analysis and decision-making. Whether you’re a pupil, a small business owner, or an accounting professional, these skills are important for maintaining the integrity and accuracy of economic info.

This is because you take the ultimate balances from the trial balance itself. That is, you do not have to undergo the effort of checking each and every ledger account. Past simply verifying the math, the trial steadiness also offers a clear, organized view of your accounts in a single place. Inside the accounting cycle, the trial stability is ready after all transactions have been posted to the ledger and earlier than any monetary statements are created.

加LINE看妹

加LINE看妹

Leave A Comment